Analysing processes helps to understand phenomena in their entirety. This was the premise that led us to create the Quarterly Thermometer of the State of the Organic Sector (QTSOS). In its second edition, the Thermometer provides comprehensive and comparative information on the organic sector in Spain. In the edition for the first quarter of 2025: January-March (Q1), companies with very diverse profiles participated, ensuring a balanced and significant representation of the sector.

Looking at the results of the QTSOS, the sample is composed of a sample represented by 38% of companies engaged in points of sale, 26% in distribution and 36% in manufacturing. Regarding the size of the companies, 48% are companies with fewer than 10 employees, 32% have between 10 and 50 employees, and 20% are companies with more than 50 employees. Finally, regarding the production areas within the organic business umbrella, companies dedicated to food, natural cosmetics, food supplements, household and cleaning products participated.

Key thermometer results

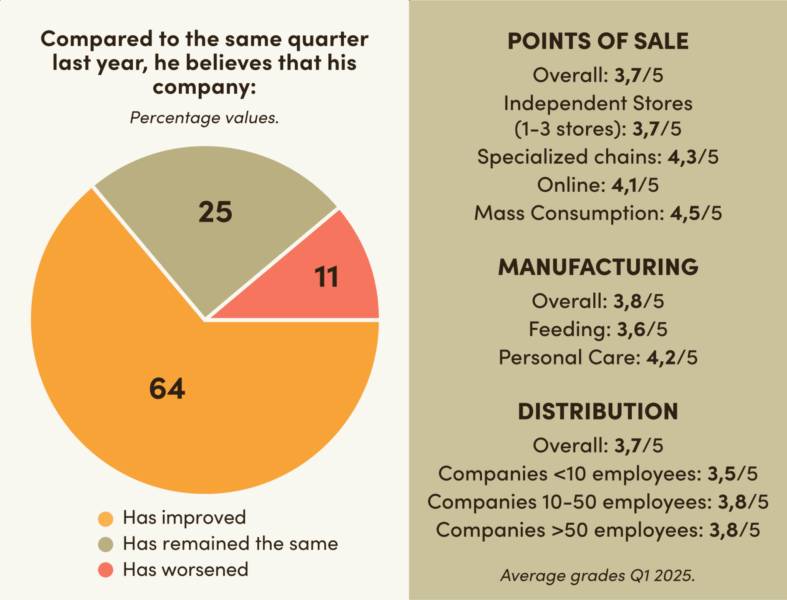

The average score for the first quarter of 2025 (Q1: January-March) is 3.7 out of 5. 64% of the companies state that their situation has improved, 25% have the same values as in the same quarter of the previous year, and only 11% indicate a negative trend.

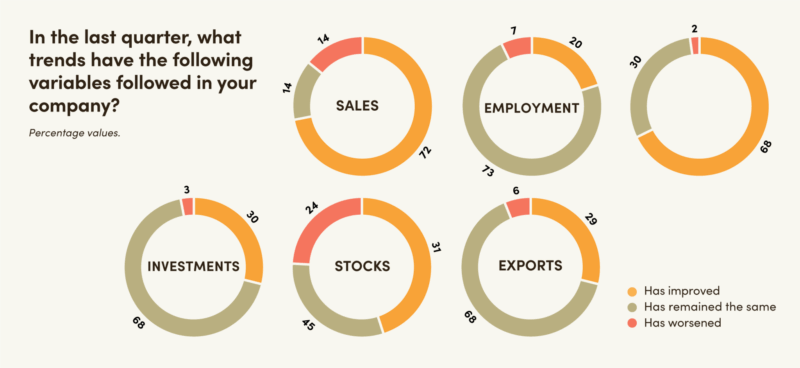

When breaking down the data by variables, we obtain the following results:

- Sales: 72% of companies report an increase in the last quarter, 14% report a steady increase and another 14% report a decrease. These data reflect sustained growth in the consumption of organic products and a solid pace of sales in the sector.

- Employment: 20% of companies have increased their number of employees, 73% have maintained their number of employees and only 7% have reduced their number of employees.

- Prices: 30% have maintained their prices, 68% have increased them slightly and 2% have managed to reduce them.

- Investment: 29% of companies increased their level of investment, 68% maintained it and 3% reduced it.

- Stocks: 45% of the companies maintained similar levels to previous periods, 31% increased them and 24% reduced them.

- Exports: the sector consolidated its export profile, with 65% of companies maintaining their levels, 29% increasing them and only 6% reducing them.

Table 1: Comparison of the percentages of the variables between Q4 2024 and Q1 2025

| VARIABLE | QUARTER | |||||

|---|---|---|---|---|---|---|

| Q4 2024 | Q1 2025 | |||||

| + | = | – | + | = | – | |

| Sales | 79% | 15% | 6% | 72% | 14% | 14% |

| Employment | 36% | 60% | 4% | 20% | 73% | 7% |

| Prices | 47% | 51% | 2% | 68% | 30% | 2% |

| Investment | 40% | 54% | 6% | 29% | 68% | 3% |

| Stocks | 35% | 46% | 19% | 31% | 45% | 24% |

| Exports | 21% | 70% | 9% | 29% | 65% | 6% |

Source: Prepared by the authors using data from QTSOS Q4 2024 and Q1 2025.

We can observe the following relevant dynamics:

- The sales trend is very positive. In both quarters, 79% and 72% of companies reported an increase in sales, exemplifying the growth of green consumption.

- Employability in the sector remains strong. In both quarters a high percentage of companies reported being able to maintain the number of employees. However, in Q4 2024 the percentage of companies that increased their staff was higher, due to the Christmas holiday context.

- Prices are one of the key economic indicators. While in Q4 most companies maintained their prices, in Q1, a large proportion of companies were forced to increase them given the current inflationary context.

72% of businesses report an increase in sales in the last quarter

Perceptions of the sector as a whole

At Bio Eco Actual we know that the sector reaches its maximum potential when it acts in a cohesive way. That is why we asked companies how they perceive the overall situation of the sector.

In general terms, companies evaluated the last quarter with an average score of 3.4 out of 5. In the same direction, compared to the same period last year, 86% consider that the situation has improved or remained the same, and 14% perceive that the sector’s situation has worsened.

Future prospects

Regarding future projections, the Thermometer indicates: first, that companies have an optimistic future outlook. Sixty-six percent believe that their situation will improve in the next quarter, 29% expect it to remain the same and only 5% believe it will get worse. Second, in relation to the evolution of the sector as a whole, 54% of the companies are confident that the situation will improve, 36% believe it will remain stable and 10% believe that the situation will worsen.

These results reinforce the positive view and confidence in the sustained growth of the organic sector in Spain.

Points of sale

If we analyse the points of sale as a whole (shops, chains, online stores and mass-market outlets), we see that the average score is 3.7, compared to 3.6 in the previous quarter (average score for points of sale in the QTSOS Q4 2024).

In terms of trends compared to the same quarter of the previous year, 64% of all outlets state that their company has improved, while 25% say that it has remained at similar levels and only 11% report a decline. With regard to future trends, the outlook is positive; 71% believe that their company will improve, 22% expect it to remain stable and 7% think that its situation will worsen.

With respect to the sector as a whole, the sales outlets rate it with an average score of 3.3, which represents a difference of 0.4 points compared to the rating they gave their own companies in the first quarter (3.7).

Compared to the same period in 2024, 28% of outlets believe that the sector has improved, while the majority, 54%, believe that it has remained at similar levels. Conversely, 18% perceive a worsening compared to Q1 last year. Looking ahead to the next quarter, the outlook for the sector remains largely stable: 43% of outlets believe that the situation will remain unchanged, 39% anticipate an improvement, and 18% foresee a worsening.

Retail outlets remain strong: 93% anticipate improvements by 2025

If we break down the points of sale by size and type, we obtain the following information:

Table 2: Results broken down by points of sale

| PRODUCTIVE SECTORS | INDICATORS | ||||||

|---|---|---|---|---|---|---|---|

| Average grade | Trend same quarter previous year* | Future trend* | Overall average grade for the sector | Trend same quarter previous year sector* | Future trends in the sector* | ||

Points of sale |

Overall | 3,7 | + | + | 3,3 | = | = |

| Independent stores (1 to 3) | 3,7 | + | + | 3,2 | = | + | |

| Specialized chains | 4,3 | + | + | 4 | + | = | |

| Online | 4,1 | + | = | 3,5 | = | = | |

| Mass Consumption | 4,5 | + | + | 3 | – | =/- | |

*(+), (=), or (-) depending on the majority trend. (+) indicates: it has improved, (=) indicates: it has stayed the same, and (-) indicates: it has worsened.

Source: Prepared by the authors using data from the QTSQS Q1 2025 survey.

We can observe the following key observations:

- Notable gap between internal and sectoral perception. Sales outlets are more optimistic about the situation of their own companies (average score: 3.7) compared to their perception of the sector as a whole (average score: 3.3). This difference is accentuated in formats such as FMCG and online.

- Chains and the online channel lead the way in terms of stable optimism. Chains and online stores are the channels that show a solid and consistent performance. Chains have high internal (4.3) and sector (4.0) ratings, with positive trends. The online channel also stands out with an average score of 4.1 and expectations of stability. These formats seem to adapt well to the current context, consolidating their position in the organic market.

- Independent shops (1 to 3 locations) have an average score of 3.7, which is the same as for all outlets. However, compared to other formats, such as chains (with a score of 4.3), smaller shops have a more moderate rating, indicating greater difficulties compared to other channels.

Manufacturing

Companies involved in the manufacture of organic products remain the mainstay of the sector. In Q1 2025, these companies give their performance an average score of 3.8, a slight decrease from Q4 2024, when the score was 4.25 out of 5.

Compared to the same quarter of the previous year, i.e. Q1 2024, producers have seen a large improvement, with 75% saying it has improved, 14% saying it has remained the same and only 11% saying it has worsened. On future trends, optimism remains high: 36% believe their values will remain similar and 64% are confident that their situation will improve in Q2 2025.

When analysing how manufacturers perceive the sector as a whole, we see that the average score given is 3.6, which represents a slight decrease compared to the internal rating for their production area.

On the other hand, 57% say that the sector has improved compared to the same quarter in 2024, 32% think that it has remained the same and finally 11% believe that the sector has worsened. Finally, when asked about Q2 2025, the predictions are highly positive; 64% expect the sector to experience growth, 32% say it will remain the same and 4% say it will decline.

If we break down production by production area, the following insights emerge:

Table 3: Broken down results of manufacturing companies according to their production area

| PRODUCTIVE SECTORS | INDICATORS | ||||||

|---|---|---|---|---|---|---|---|

| Average grade | Trend same quarter previous year* | Future trend* | Overall average grade for the sector | Trend same quarter previous year sector* | Future trend of the sector* | ||

| Manufacturing | Overall | 3,8 | + | + | 3,6 | + | + |

| Feeding | 3,6 | + | + | 3,6 | + | + | |

| Personal care | 4,2 | + | + | 3,7 | + | + | |

*(+), (=), or (-) depending on the majority trend. (+) indicates: it has improved, (=) indicates: it has stayed the same, and (-) indicates: it has worsened.

Source: Prepared by the authors using data from the QTSQS Q1 2025 survey.

Key dynamics observed:

- Personal care leads the growth perception. Within the manufacturing sectors, personal care stands out with an average score of 4.2, the highest among the categories. This sector, like the rest, shows a positive trend both in comparison to the same quarter last year and in future projections, reflecting sustained optimism on the part of companies.

- The food sector remains stable. Although the food sector has a lower average score than manufacturing as a whole and personal care manufacturing, the trends indicate that most companies consider that the situation has improved compared to the same quarter last year, suggesting that, although not leading in scores, it remains a growth area with a positive outlook.

Distribution

For companies involved in the distribution of organic products, the quarterly average score is 3.7, slightly lower than the previous quarter’s 3.8. However, compared to the same quarter in 2024, the general trend is one of improvement: 76% say they have increased performance and 24% say they have maintained them. In terms of the future, 59% predict improvement in values, 35% say they will remain the same and 6% believe their situation will worsen.

In sectoral terms, companies set the average score at 3.2, which is slightly lower than the score for their own sector. Compared to Q1 2024, 41% believe the sector has improved, while 35% believe it has stayed the same, and 24% believe it has worsened. Looking ahead to the next quarter, 47% of companies expect growth, the same percentage expect growth to remain the same and 6% expect a decline.

If we break down distribution by company size, we obtain the following information:

Table 4: Results broken down by distribution companies according to their size

| PRODUCTIVE SECTORS | INDICATORS | ||||||

|---|---|---|---|---|---|---|---|

| Average grade | Trend same quarter previous year* | Future trend | Overall average grade for the sector* | Trend same quarter previous year sector* | Future trend of the sector* | ||

| Distribution | Overall | 3,7 | + | + | 3,2 | + | +/= |

| Companies <10 employees | 3,5 | +/= | +/= | 3,5 | + | + | |

| Companies with 10-50 employees | 3,8 | + | + | 3,2 | +/- | +/= | |

| Companies >50 employees | 3,8 | + | + | 3,1 | = | = | |

*(+), (=), or (-) depending on the majority trend. (+) indicates: it has improved, (=) indicates: it has stayed the same, and (-) indicates: it has worsened.

Source: Prepared by the authors using data from the QTSQS Q1 2025 survey.

Key points:

- Larger companies have a more optimistic perception. Both companies with 10-50 employees and those with more than 50 employees report an average score of 3.8, the highest within the different company sizes. Both categories also display a positive trend when compared with the same quarter of the previous year and expectations for the future, suggesting stable optimism in these groups.

- The sector as a whole has a stable and positive trend. Overall, the distribution sector has an average score of 3.7, reflecting a positive performance, with the majority of companies in that sector reporting improvement or stability in both the current quarter and expectations for the future.

Sectorial challenges

Finally, we consider it essential to address sectoral challenges as means of anticipating and preparing for them. Given the diversity of actors that make up the sector and their varied productive activities, the challenges are multiple. However, there are some that stand out for their persistence and relevance. Firstly, due to global uncertainty, many companies express concern about how the organic sector might be affected by tariff increases and a possible reduction in exports.

Next, there are also references to the sector’s ability to continue to offer its products at competitive prices in relation to non-organic products and to the generalised increases in the cost of raw materials due to inflation. Thirdly, there is a lack of institutional support for the organic sector, both at the bureaucratic level and in terms of economic facilities and training for new generations. In this sense, it is suggested that organic production does not receive the level of commitment it deserves at the institutional and administrative level, which does not sufficiently value the social and environmental benefits that this production model brings. In the same vein, there are a significant number of companies that have doubts about the sector’s real capacity for generational renewal, i.e. the ability to maintain organic production as a livelihood for future generations.

Another of the sector’s concerns is to continue to offer specialised customer service, i.e. a personalized attention and knowledgeable recommendations, as opposed to the depersonalisation of services. Finally, the need for clear call for greater public awareness campaigns on the benefits of organic production and consumption compared to conventional production is also mentioned, as well as the need to publicly denounce greenwashing practices and the threat of unfair competition that threatens the sector disguised under the label of “greenwashing”.

Author: Bio Eco Actual Editorial Staff.

The article The organic sector remains strong: 89% have improved or maintained their situation and 95% are optimistic about the future appeared first on Bio Eco Actual.